By: Michael McMahon – COO – Scio Diamond Technology Corporation

Is the real “disruptive technology innovation” of cultured diamond for the industrial world, “mass production?” Throughout the last six or seven decades man has produced, in one shape or another, “man-made” diamond. It has many names including cultured diamond, lab-grown diamond, man-made diamond, HPHT, CVD, etc. Some have even attempted to place CZ into this category.

As is the case in most industries, only a few survive. Those companies that are surviving today, few that they are, can truly make “diamond.” Not natural diamond, not pretend diamond, but “REAL DIAMOND.”

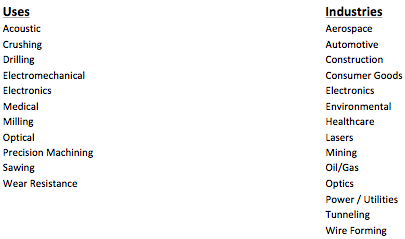

While some producers have the ability to make beautiful gemstones in varying colors and grades, the industrial need for diamond is almost beyond belief. Through research and development efforts around the world, hundreds, if not thousands, of brilliant scientists and PhD’s have developed a multitude of uses for diamond in the industrial and commercial arenas. More are being developed every day.

There are literally so many potential applications for industrial diamond that the demand cannot be met. Moreover, the quantities now being supplied are not being produced economically, limiting the real quantities demanded. The failure to produce economically feasible diamond for industrial use is robbing the world of the material’s dynamic benefit.

Diamond Growth

Scio Diamond’s mission is to end the drought. Scio Diamond has just begun production of CVD Single Crystal Diamond in Greenville, SC. Its patented methodologies and processes, combined now with good manufacturing discipline, support Scio’s drive to mass production. Scio has started its mass production advancement process that will culminate in the production of over 150,000 gross carats of diamond annually from less than 15 reactors. The core of this mass production drive will be the application of Scio’s multiple patented growing technologies.

Scio’s proven process for seed replication and harvesting and Mosaic seed creation allows it to advance rapidly from its production startup of multiple diamond seeds measuring up to twenty four (5mm x 5mm) to multiple Mosaic seeds measuring at a minimum of 25mm x 25mm, in the same reactor. Note, for comparison purposes, the grow time for all runs in this article is approximately 7 days. The expected up time of the reactors is 90% or greater.

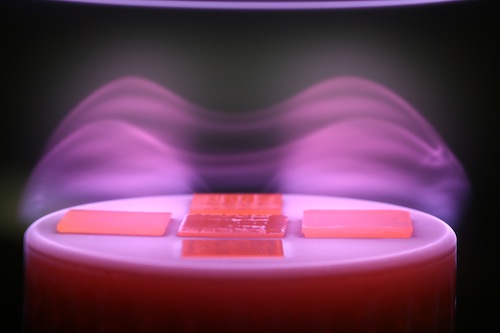

The photo below shows Scio’s S3532 technology. This picture shows 2,4 5mm x 5mm seeds in the reactor growing simultaneously.

The S3532 technology is used initially for Scio’s self-sustaining seed production, as well as numerous industrial uses, specifically in the cutter blade market sector. Upon completion of a S3532 growth run, each seed will yield a rough diamond of approximately 2 gross carats or up to 64 gross carats per run.

Following the successful completion of Scio’s growth run at S3532 technology, Scio will implement its 2nd phase of proven S3724 technology. The S3724 technology is generally the same as S3532 but with differences in the seed size and the number of seeds on the growing platform. The minimum size seed in these runs is 7mm x 7mm. This technology will yield up to 92 rough gross carats per run or a 48% increase over the S3532 technology.

These two technologies are based on Scio’s 3” growing platform. It should be noted that each of these technologies could be increased dramatically by changing to the 4” growing platform, thereby increasing growing capability by another 78%. The gross carat yield expectation would expand in line with that capability.

In parallel with the production runs using S3532 and S3724 technologies, Scio Diamond will be growing its larger seeds. This is accomplished by using a patented Mosaic Process.

The Scio Grown Diamond Mosaic Separation is the patented process used by Scio to replicate and then fuse multiple seed diamonds. This process allows for separation at an atomic level, making possible the production of large volume single crystals.

Depending on product demand, Scio will be progressively creating seeds in multiple bar and plate formations to adapt to customers’ specific needs. This configuration will use the proven S31M and S48M technologies. Seed sizes will be created to grow product ranging from 5mm x 10mm x 1/2mm thick, to 28mm x 28mm x 5mm thick.

The photo below shows Scio’s S31M technology. This picture shows a 25mm x 25mm seed, with approximately 750 microns of growth after a single day’s growth.

At full growth this diamond plate will measure 25mm x 25mm x 4-5mm thick, yielding 39-49 gross carats of diamond from each plate. The yield of 39-49 diamond gross carats is dependent on finished thickness and actual seed width and length. In addition, Scio will make customized bars of diamond focusing on specific clients, or a cluster of clients desiring similar requirements. For instance, if a 3mm x 2mm x 1mm finished diamond part is needed, Scio will optimize the growth dimensions to enable efficient fabrication of the final product.

The photo below shows Scio’s S35M technology. This picture shows 5, 25mm x 25mm seeds, with approximately 750 microns of growth.

At full growth on non-specialized runs, the S35M technology utilizing five 25mm x 25mm Scio generated seeds will produce between 195 and 245 gross carats per run.

Scio’s most recent proven technology is its S48M generation (not pictured). The S48M, which begins with eight 25mm x 25mm seeds and at full growth is 4-5mm thick, yielding between 312 and 392 diamond gross carats per run. Each of the aforementioned technologies will average approximately 45 runs per year.

Fabrication

Given this mass production of cultured diamond for industrial uses, the need for increased capability for fabrication and polishing becomes the next hurdle. Diamond growth is not a labor-intensive business. While multiple growers, once started and in cycle, can be run by one operator, great attention to detail is needed in operating lasers and polishing operations and the ratio of labor to machine is higher.

Example: The Scio S35M technology at 1.2MM growth thickness produces approximately 55 gross carats per 3 day run. Now your client wants you to produce 3mm x 2mm x 1mm cutter blades and they need to be polished on top and bottom. How many blades can you get from (5) five, 25mm x 25mm x 1.2mm seamless diamond plates? The math tells you with a 20% kerf loss you would have approximately 400. If your client wants 1,000 of these per month, how many lasers and operators will you need to fabricate and polish for this single customer?

Summary

What does all this mean to the industrial diamond market? It is GOOD NEWS! As more and more diamond is available and production is economically scalable, the hundreds of industrial applications have a much greater chance of coming to fruition for the masses and allowing the world to experience the impact of life-altering technology that diamond can bring. Through innovation and the application of proven science and technologies and matching that with GMP processes, large quantities of diamond material can be now be made economically per client requirements.

-42.498

-42.498 -5.49

-5.49 +0.03

+0.03